The public should just “accept that they’re worse off” than they were a year ago amid rampant inflation, an ivory tower Bank of England boss said this week.

Huw Pill, the chief economist for the UK’s central bank, said that people should not seek salary increases to cope with the soaring inflation, which the Bank of England predicted would be a “temporary” phenomenon in August of 2021, yet, inflation remains in double digits in Britain nearly two years later.

In a ‘let them eat cake’ moment, Pill, who reportedly earns a salary of £190,000 per year, said that rather than demanding pay increases commeserate with the rise in cost of living, the central banker said that people should just “accept that they’re worse off” condeming the “reluctance” of families to come to grips with the impacts of inflation on their way of life.

The central banker argued that if people continue to ask for pay hikes, it will have a ripple impact of increasing prices across the board.

“If the cost of what you’re buying has gone up compared to what you’re selling, you’re going to be worse off,” Pill said in comments reported by The Times.

“So, somehow in the UK, someone needs to accept that they’re worse off and stop trying to maintain their real spending power by bidding up prices whether through higher wages or passing energy costs on to customers.

“What we’re facing now is that reluctance to accept that yes, we’re all worse off and we all have to take our share.”

British Central Bank Admits it ‘Underestimated’ Inflation, as UK Heads Towards 11 Per Centhttps://t.co/sxpnT7nwNi

— Breitbart London (@BreitbartLondon) June 18, 2022

The comments from the central banker came as the inflation for grocery itelms hit a staggering 17.3 per cent in the month leading up to April 16. Meanwhile, overall inflation in the UK stood at 10.1 per cent in March.

To add insult to injury, research conducted by the National Institute for Economic and Social Research found that while wages increased by 6.6 per cent in the quarter to February, when calculating the figures to include inflation, the British public saw their wages decline in real terms by an average of 3.5 per cent for public workers and 2.8 per cent for private sector workers.

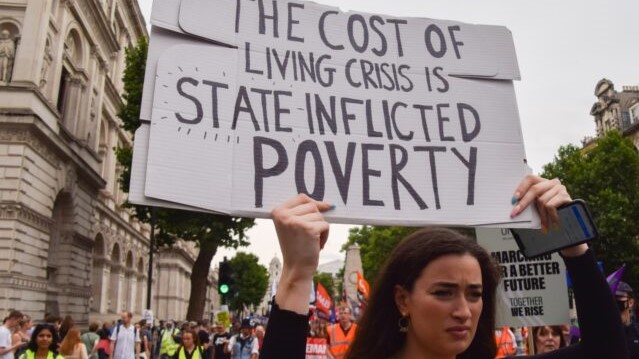

Yet, despite the economic hardship facing millions of citizens, the British government of Prime Minister Rishi Sunak has saw fit to impose the highest tax burden on the public since the Second World War.

Mr Sunak, a former Goldman Sachs banker who married into the tech elite of India, making him richer by some estimates than King Charles III, has argued that the high tax burden is necessary to pay back debts accumulated during the Chinese coronavirus crisis, when Sunak handed out billions to businesses to remain shut.

Rishi Sunak Pledges to Cut Inflation and Stop Illegal Migrants… Eventuallyhttps://t.co/htllbtwalu

— Breitbart London (@BreitbartLondon) January 4, 2023

Follow Kurt Zindulka on Twitter here @KurtZindulka