The Ballad of Bidenflation

Joe Biden’s tenure as president will likely be remembered as an era of economic mismanagement, a vivid demonstration of what happens when the aimless pursuit of power combines with unbridled ideology to trump prudence. While every administration has its challenges, few have left such a clear trail of cause and effect as Biden’s policies did in fueling inflation—a scourge that has eroded the financial well-being of millions of Americans, upended the economy, and sent the once-ascendant Democratic party into a defensive crouch.

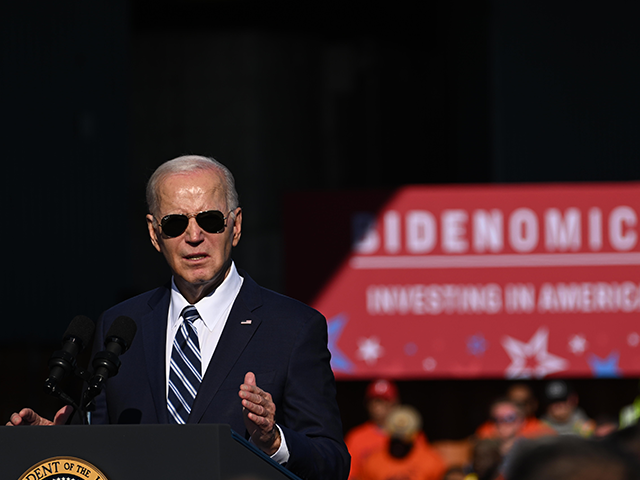

The last lamps of Joe Biden’s presidency are being extinguished, their light fading into history, and we can be assured that we will never again find ourselves subject to their glare. This is the final Breitbart Business Digest of Biden’s presidency, a farewell of sorts to an era defined by economic missteps and the consequences of misguided policies. Like a prisoner scratching out the days of his captivity prior to release, we now etch into the wall one final marker.

To understand how this predicament unfolded, we must begin with Biden’s early days in office. The administration entered the White House with an agenda as ambitious as it was miscalculated. Riding on a wave of COVID-era crisis politics, Biden and his economic advisers championed the $1.9 trillion American Rescue Plan, the largest single stimulus package in American history. Sold to the public as a necessary measure to combat pandemic-induced hardships, it ignored warnings from economists across the political spectrum that the size and timing of such spending could unleash inflationary pressures.

Larry Summers articulated the risks early in 2021:

“Even six months ago, it was reasonable to regard slow growth, high unemployment, and deflationary pressures as the predominant risk to the economy. Today, while continuing relief efforts are essential, the focus of our macroeconomic policy needs to change.

Inflationary pressures are mounting from the boost in demand created by the $2 trillion-plus in savings that Americans have accumulated during the pandemic; from large-scale Federal Reserve debt purchases, along with Fed forecasts of essentially zero interest rates into 2024; from roughly $3 trillion in fiscal stimulus passed by Congress; and from soaring stock and real estate prices.

This is not just conjecture. The consumer price index rose at a 7.5 percent annual rate in the first quarter, and inflation expectations jumped at the fastest rate since inflation indexed bonds were introduced a generation ago. Already, consumer prices have risen almost as much as the Fed predicted for the whole year.”

In February 2021, Olivier Blanchard, a renowned liberal macroeconomist, presented a detailed case against the scale of spending in the American Rescue Plan. He argued that the Biden administration’s excessive Covid relief efforts would trigger a significant surge in inflation. Using a straightforward economic model, Blanchard’s predictions closely mirrored the inflationary reality that eventually unfolded.

That Biden was too infirm to resist the clamor of his party’s left-wing constituencies speaks volumes about his lack of fortitude and judgment. It revealed a hollowness at the heart of Biden’s presidency—even his entire political career or really his entire life. It was always more about winning office and exercising power than the pursuit of particular noble achievements. That ambitious abyss was filled by the agendas of those who style themselves as representative of the aggrieved and afflicted. What was a little bit of inflation when America had been a nest of villainous vipers since 1619?

Warnings over inflation were treated as obviously wrong. Here’s what Binyamin Appelbaum, the most economically literate member of the editorial board of the New York Times, wrote in response to Blanchard:

The fear of inflation has become a greater threat to the American economy than inflation itself.

The Biden administration wants to spend $1.9 trillion to combat the coronavirus and its economic effects. Congress is grappling with the details, some of which certainly could be improved. But the plan also faces opposition on the grounds that spending so much could revive inflation.

“This would not be overheating; it would be starting a fire,” tweeted Olivier Blanchard, formerly the chief economist of the International Monetary Fund. Lawrence Summers, a senior figure in each of the previous two Democratic administrations, warned in The Washington Post of “inflationary pressures of a kind we have not seen in a generation.”

These warnings should sound familiar because we’ve been hearing them for 40 years. The threat of inflation has been invoked repeatedly as the justification for placing limits on federal spending, for restraining the pursuit of full employment and for limiting the economic power of workers.

It is a tired refrain that seems to be sung mostly by those whose views were forged during the stagflationary 1970s. But we live in an era of anemic inflation, and changes in the economic landscape since the ’70s have significantly reduced the chances of a revival, including the watchfulness of the Federal Reserve, workers’ loss of bargaining power and the effects of globalization.

Even as late as November of 2021, when the economy was quite obviously on the path to much higher inflation, progressives were declaring that rising concern over inflation was all just a Republican psy-op.

“Is inflation running rampant? No,” proclaimed Rakeen Mabud, the chief economist of an outfit called the Groundwork Collective, in a video posted to Twitter by a different leftist group called Invest in America. “So these one-time price increases are the result of returning consumer demand and a sign of economic recovery.”

Note that the tweet claims it is “debunking” the “GOP’s inflation disinformation.” Anne Price, an economist at yet another leftwing pressure group called the Insight Center, appears in the video to say that the “reality is that mildly elevated inflation is actually a signal that things are going well.”

For months, Biden’s economic team insisted that inflation was “transitory,” a temporary hiccup that would subside as supply chains normalized. Over and over again, Biden and his proxies claimed that inflation had been overcome—only to have it rise again.

This narrative crumbled as inflation proved persistent, forcing the Federal Reserve to undertake its most aggressive rate-hiking campaign in decades. The Fed’s efforts, while necessary, came at a steep cost: higher borrowing costs, a slowdown in housing and business investment, and the specter of a potential recession.

A Broader Failure of Leadership

Biden’s missteps on inflation weren’t limited to fiscal policy. His administration’s regulatory agenda, particularly its aggressive push for green energy subsidies under the Inflation Reduction Act, further strained supply chains and raised costs for key inputs like energy and raw materials. The requirement that all programs be shaped to fit the climate change transition schemes and DEI demands further exacerbated the problem of an economy whose output could not keep up with demand. While the president’s allies argue that these policies lay the groundwork for a greener and fairer economy, their actual effect was to exacerbate inflationary pressures.

Unsurprisingly, voters took notice. Polls consistently showed that inflation ranked as the top economic concern for Americans, and Biden’s approval ratings on economic issues languished. This erosion of trust extended beyond inflation, leading to broader doubts about the administration’s competence and priorities. By prioritizing ideological goals over pragmatic solutions, Biden has alienated not just conservatives but also moderate and independent voters who had hoped that his election would bring about something like a return to normalcy following the chaos of the pandemic.

Many pundits sympathetic to Democratic politicians and the Biden administration were certain that public distrust and resentment created by inflation would fade as the worst of economic crisis subsided. This was a serious underestimation of how deeply betrayed many Americans felt by Biden’s unleashing of inflationary forces on their household finances.

While some have argued that the ubiquity of inflation absolves Biden, pointing to high inflation rates in other countries as evidence that his policies were not uniquely harmful. But this defense falls flat. Inflation abroad was often the result of similarly flawed economic leadership—a global outbreak of bad policymaking. As economist Jason Furman observed, the American Rescue Plan was far larger relative to GDP than comparable stimulus packages in other advanced economies, amplifying U.S.-specific demand pressures. The ubiquity of bad economics does not absolve its practitioners of the effects. Rather, it underscored the need for disciplined policymaking, even when others fail to exhibit it.

And so voters in the U.S. and around the world have been rejecting the leaders and their parties that loosed about their nation’s the long-dormant threat of inflation. That, perhaps, may be looked at as the silver-lining of this episode, the bright note at the end of this mournful ballad. Bidenflation cost us dearly but it brought forth a political whirlwind that swept his party from power, delivered the House and Senate into Republican hands, and returned Donald Trump to the White House.

As the final embers of Biden’s presidency smolder, they illuminate a lesson as old as ambition itself: that power without purpose kindles not progress, but calamity. Inflation was not an inevitable storm—it was the work of hands too eager to grasp and too weak to steer. History will remember not just the cost of this folly, but the folly of those who dared to dismiss its price.