Argentina struck a deal with Beijing on Wednesday to stop using U.S. dollars to pay for Chinese imports and embrace the yuan instead.

The measure, driven by Argentina’s leftist President Alberto Fernández, is designed to relieve the South American country’s dwindling dollar reserves, AP reports.

The deal further enhances China’s rise on the world stage and the diminished role of the U.S. on a host of fronts under President Joe Biden.

After reaching the agreement with various companies, Argentina will use the yuan for imports from China worth about U.S.$1.04 billion from next month, accelerating trade with China as Beijing seeks to gain a further foothold in South America.

In November last year Argentina expanded a currency swap with China by $5 billion in an effort to increase its yuan reserves.

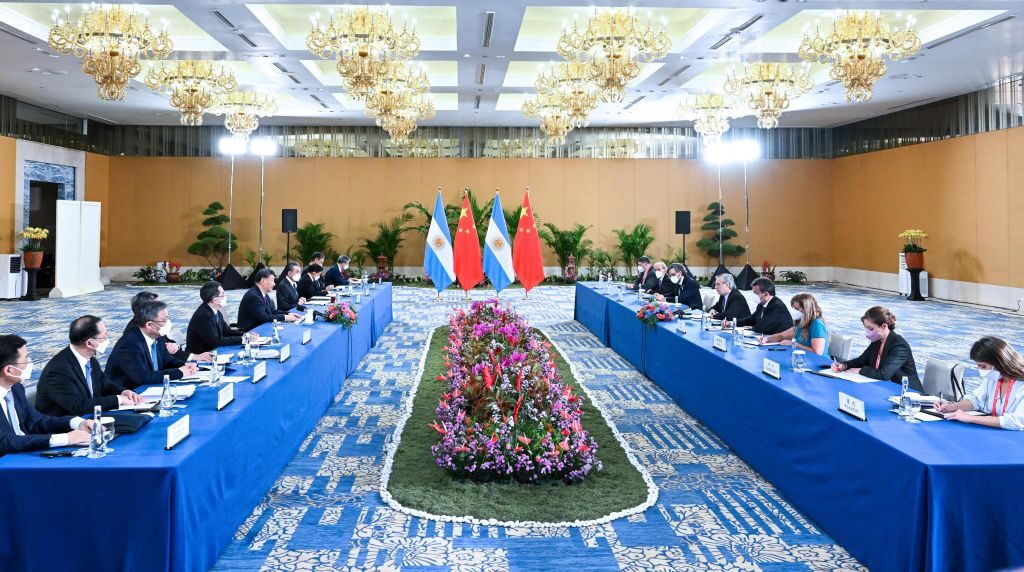

Chinese President Xi Jinping meets with Argentine President Alberto Fernandez in Bali, Indonesia, Nov. 15, 2022, as the two countries work to build a closer alliance (Rao Aimin/Xinhua via Getty)

That agreement allowed Argentina “to work on the possibility” of advancing the rate of imports with yuan-denominated import orders being authorised in 90 days rather than the standard 180 days.

The decision comes as Argentina battles critical levels in its dollar reserves amid a sharp drop in agricultural exports caused by a historic drought, as well as political uncertainty ahead of elections this year.

It has also been working hard to build a relationship with Beijing after having officially joined China’s infrastructure-building Belt and Road Initiative (BRI) last year.

Iran and Argentina recently submitted applications to join an association of emerging economies known as BRICS, which is headed by China and Russia, Reuters reported on Tuesday. https://t.co/5yvBSgyK2V

— Breitbart News (@BreitbartNews) June 30, 2022

Argentina’s government finalized a deal with Beijing soon after to construct a nuclear plant based on Chinese technology near Buenos Aires, Argentina’s national capital, in the near future.

The Chinese Communist Party will reportedly provide $8 billion in financing toward the project’s $12 billion total budget.

As Breitbart News reported, Argentina currently owes the International Monetary Fund (IMF) $44 billion.

The international organization is in talks with Argentine authorities to finalize a fourth review of its program that includes a flexibilization of the proposed foreign exchange reserve accumulation as Argentina, whose foreign reserves are now at a $5 billion deficit, cannot comply with the current goals.