John Schroder, Louisiana State Treasurer, announced Wednesday that the Pelican States would sell nearly $800,000,000 in assets to BlackRock.

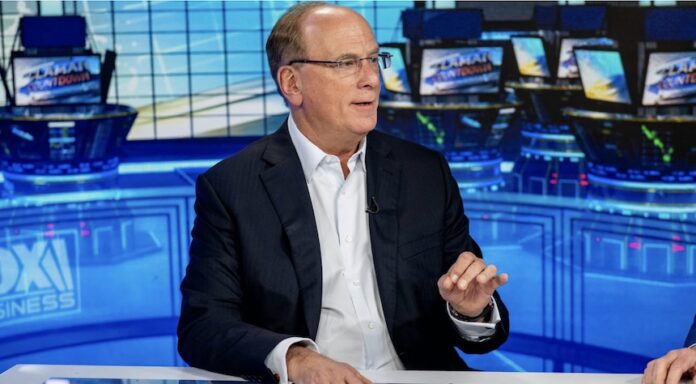

Larry Fink, BlackRock CEO, was informed by an official that ESG investing is against Louisiana’s law on fiduciary obligations. This requires “a sole focus upon financial returns for state beneficiaries.”

In a press release, Schroder stated that “This divestment was necessary to protect Louisiana against mandates BlackRock has requested that would cripple the critical energy sector.” “I will not spend one penny of Treasury funds on a company that will take food off the tables, money from the pockets, and jobs away for hardworking Louisianans,” Schroder stated.

Louisiana has already taken $560 million from BlackRock. It intends to continue strategic divesting until the company is worth $794 million. Schroder wrote that remarks made at his meeting with representatives from BlackRock “contradicted most public messaging” Fink has advanced in the media.

Fink stated in his latest letter to chief executives that “climate risks are investment risks.” According to BlackRock’s investment stewardship report, it has “voted against climate issues” against 53 portfolio companies and placed 191 others “on notice.”

Fink was informed by Schroder that “this divestment was necessary to protect Louisiana against actions and policies which would actively seek to weaken our fossil fuel sector.” Your support for ESG investing is not consistent with the best economic interests or values of Louisiana. I can’t support an institution that would deprive our state of one of its strongest assets. We cannot allow our economy to be crippled.

This divestment is a result of Texas Comptroller Glenn Hegar’s recent analysis that found that BlackRock and nine others have violated state law by refusing to deal or “terminating business activities” with companies involved in the production and using fossil fuels “without an ordinarily business purpose.”

Derek Kreifels, CEO of the State Financial Officers Foundation, noted in his comments that other states, including Arkansas, West Virginia, Utah, and West Virginia, have also rejected the “weaponized ESG movement.” He stated that the “reckless agenda” of these people are driving up the cost of daily goods such as groceries, gas, and energy, and rob Americans of their retirement funds.

The Securities and Exchange Commission (SEC), amid state governments’ attempts to discourage ESG investment, is creating requirements that require companies to report the “material impact of climate change” on operations, the effect of “climate-related events” such as severe storms on transaction activities, and the risk management processes used in mitigation.

CNBC recently conducted a poll and found that only 25% of chief financial officers support this policy. This is mainly because they don’t see the connection between the profits generated by the disclosures and the costs to their businesses.