Inflation shot up in December at a rate of 3.4% showing that “Bidenomics” has as much chance of success as Joe has of not faceplanting on an airplane stairway and nearly guarantees the Federal Reserve will not cut interest rates for economic reasons.

This is the summary provided by the Bureau of Labor Statistics.

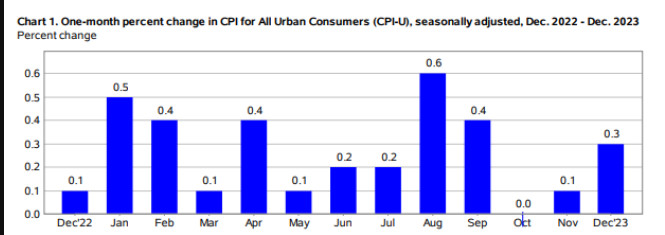

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent in December on a seasonally adjusted basis, after rising 0.1 percent in November, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.4 percent before seasonal adjustment.

The index for shelter continued to rise in December, contributing over half of the monthly all items increase. The energy index rose 0.4 percent over the month as increases in the electricity index and the gasoline index more than offset a decrease in the natural gas index. The food index increased 0.2 percent in December, as it did in November. The index for food at home increased 0.1 percent over the month and the index for food away from home rose 0.3 percent.

The index for all items less food and energy rose 0.3 percent in December, the same monthly increase as in November. Indexes which increased in December include shelter, motor vehicle insurance, and medical care. The index for household furnishings and operations and the index for personal care were among those that decreased over the month.

The all items index rose 3.4 percent for the 12 months ending December, a larger increase than the 3.1-percent increase for the 12 months ending November. The all items less food and energy index rose 3.9 percent over the last 12 months, after rising 4.0 percent over the 12 months ending November. The energy index decreased 2.0 percent for the 12 months ending December, while the food index increased 2.7 percent over the last year.

Key Points

This report shows that the smaller increases in inflation in October and November were just a temporary blip in what appears to be the new normal of 0.3-plus percent monthly/3+ percent annual increases in inflation.

This will worsen unless some degree of fiscal discipline starts to appear in Washington.

The 3.4 percent annual inflation rate is the highest since 2011.

Rent increased by 6.2% in 2023. Auto insurance increased by 20.3%. The “food away from home” category increased by 5.2% showing the impact of the “$15/hour” movement. But never mind, that food cost will go down next year.

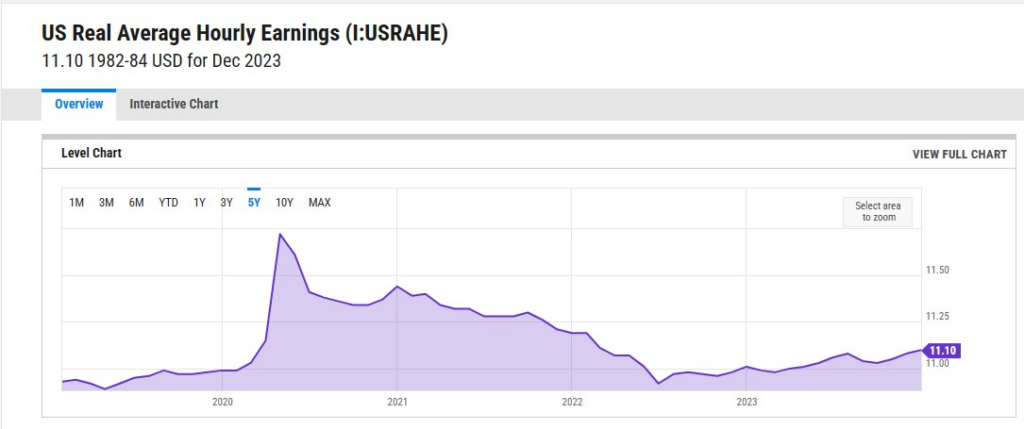

On the positive side, real wages are nice and flat, so they won’t contribute to inflation.